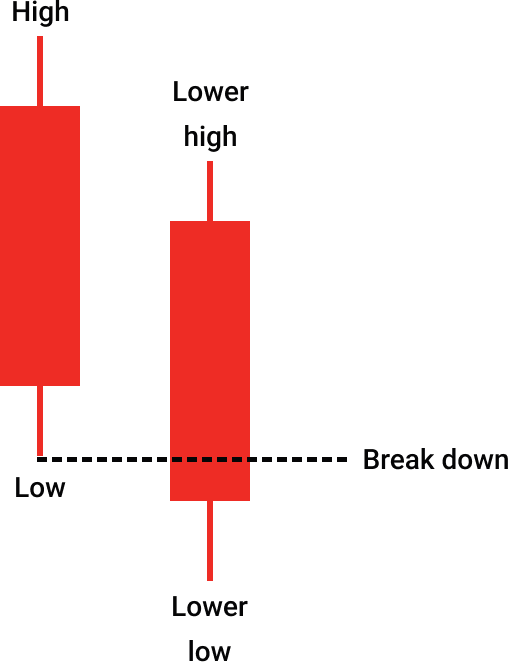

✤ Setup Conditions:

✤ Red to red breackout

1. 1st candle’s close must be less than 1st candle’s open, it means 1st candle is a bearish candle.

2. 2nd candle's close must be less than 2nd candle's open, it means 2nd candle is a bearish candle.

3. 2nd candle’s low must be less than 1st candle’s low, it means 2nd candle has a lower low.

4. 2nd candle’s high must be less than 1st candle’s high, it means 2nd candle has a lower high.

5. 2nd candle’s close must be less than 1st candle’s low, it means 2nd candle is a breakdown candle.

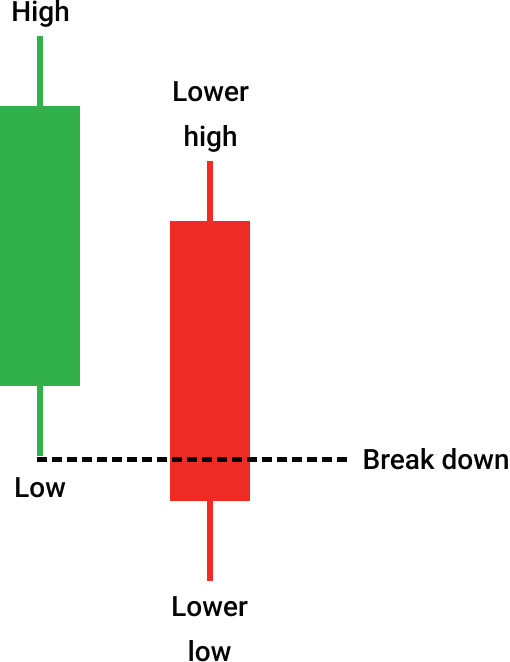

✤ Green to red breackdown

1. 1st candle’s close must be greater than 1st candle’s open, it means 1st candle is a bullish candle.

2. 2nd candle's close must be less than 2nd candle's open, it means 2nd candle is a bearish candle.

3. 2nd candle’s low must be less than 1st candle’s low, it means 2nd candle has a lower low.

4. 2nd candle’s high must be less than 1st candle’s high, it means 2nd candle has a lower high.

5. 2nd candle’s close must be less than 1st candle’s low, it means 2nd candle is a breakdown candle.

✤ Breakdown

✤ Definition

☛ A breakdown happens when the price moves below a key support level or trading range, signaling potential downward momentum.

✤ Characteristics

☛ The price falls below a previously established low (support level).

☛ It is usually accompanied by high trading volume, confirming the bearish sentiment.

✤ Implications:

☛ Indicates bearish sentiment and the likelihood of further declines.

☛ Traders often enter short positions or sell holding when a breackdown is confirmed.

✤ Example:

☛ If a stock has been trading between ₹100 and ₹120, a breakdown occurs when the price falls below ₹100.