✤ Setup Conditions

1. 1st candle’s close must be greater than 1st candle’s open, it means 1st candle is a bullish candle.

2. 2nd candle’s close must be less than 2nd candle’s open, it means 2nd candle is a bearish candle.

3. 2nd candle’s high must be greater than greater than 1st candle’s high, it means 2nd candle has a higher high.

4. 2nd candle’s low must be less than 1st candle's low, it means 2nd candle has a lower low

5. 2nd candle’s entire range must be greater than entire range of 1st candle.

6. 2nd candle’s close must be less than 1st candle's low.

7. 3rd candle confirmation needed.

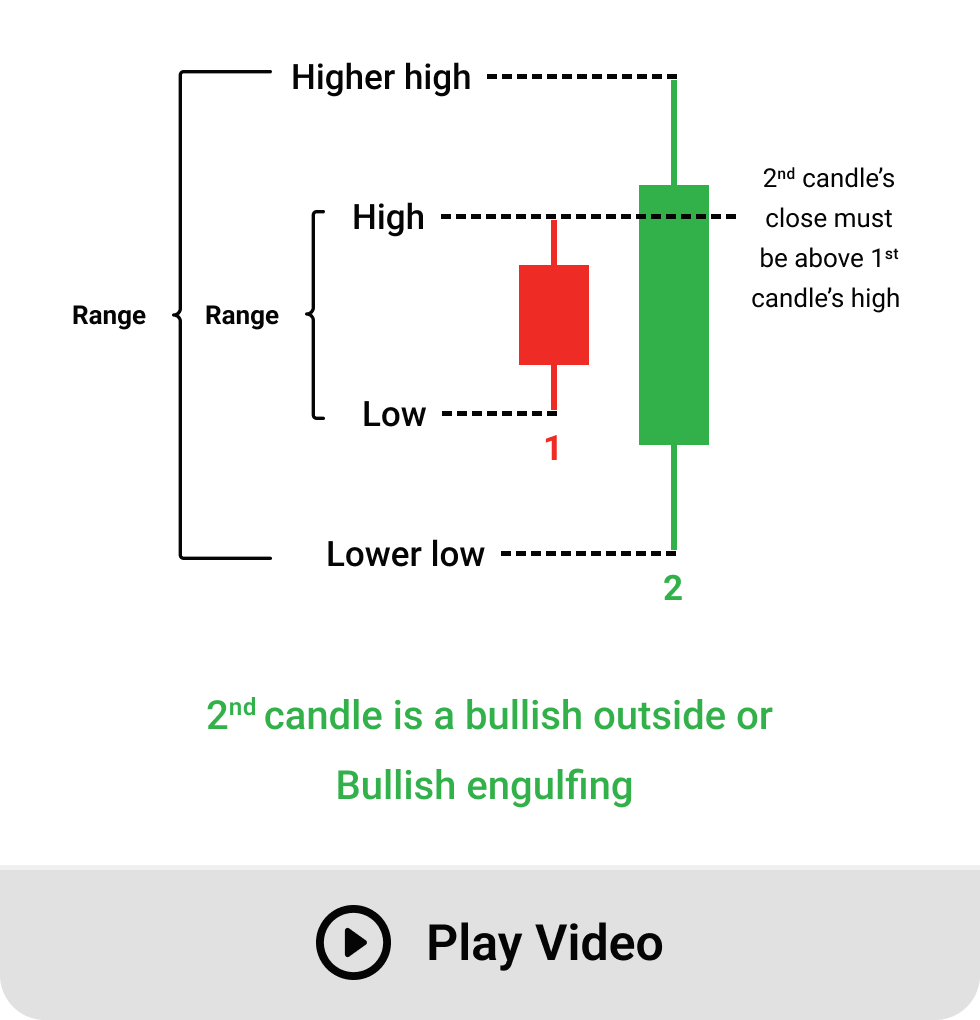

A Bullish Engulfing candlestick pattern signals a potential reversal from a downtrend to an uptrend. it consists of two candles:

1. First Candle

☛ A small bearish candlestick (red/ black body) indicating selling pressure.

2. Second Candle

☛ A smaller bullish candlestick (small green/white body) that is entirely contained within the body of the first candle.

✤ Key Characteristics

☛ The second candle's open is lower than the first candle's close, and it's close is higher than the first candle's open.

☛ indicates a strong shift from bearish to bullish sentiment.

✤ Interpretation

☛ Suggests buyers have taken control, potentially leading to an upward move.

☛ More reliable if it forms near a support level or after a significant downtrend.

✤ Confirmation

☛ Traders typically wait for the next candle to close higher to confirm the bullish reversal.