| Aspect | Bullish Candlestick | Bearish Candlestick |

|---|---|---|

| Color | Typically green or white | Typically red or black |

| Open vs. Close | Close price > Open price | Close price > Open price |

| Market Sebtiment | Indicates buying pressure (bullish) | Indicates selling pressure (bearish) |

| Trend Signal | Signals upward momentum | Signals downward momentum |

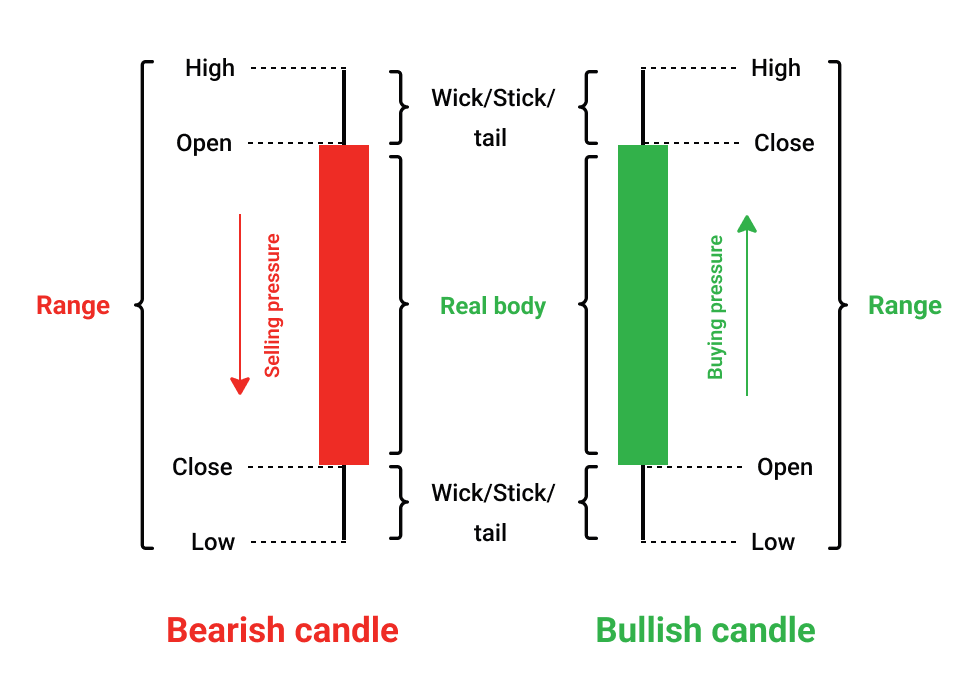

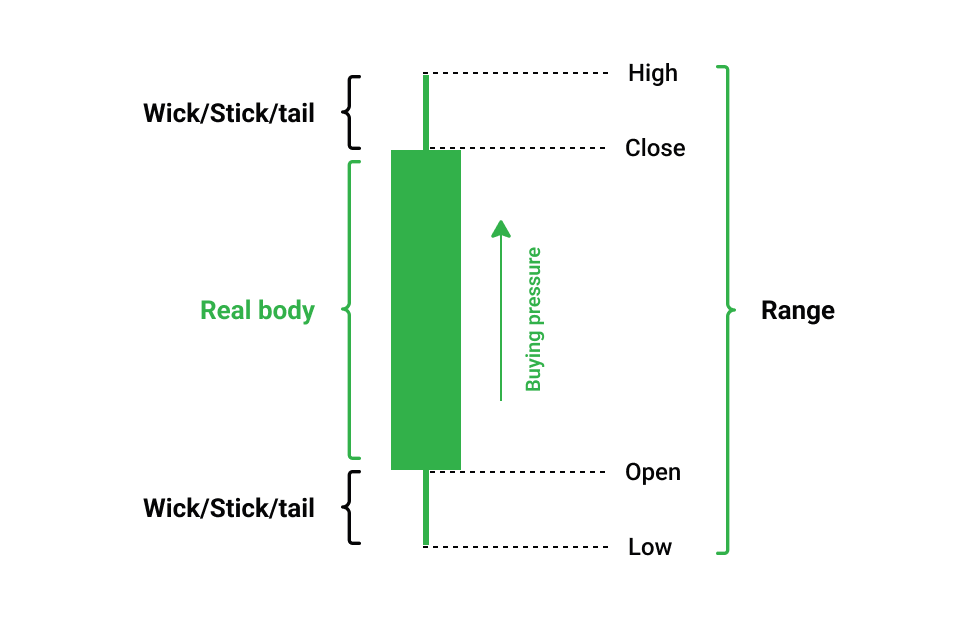

✤ Definition:

☛ A candlestick that indicates price appreciation or upward movement during the selected time frame. It reflects that the closing price is higher than the opening price.

✤ Appearance:

☛ The body of the candlestick is typically colored green or white (though colors can vary based on chart settings).

☛ Open price is at the bottom of the body.

☛ Close price is at the top of the body.

✤ Shadows (Wicks):

☛ Upper Shadow: Represents the highest price during the period.

☛ Lower Shadow: Represents the lowest price during the period.

✤ Interpretation:

☛ Indicates that buyers (bulls) are in control and are driving prices upward.

☛ Common in uptrends or as part of bullish reversal patterns after a downtrend.

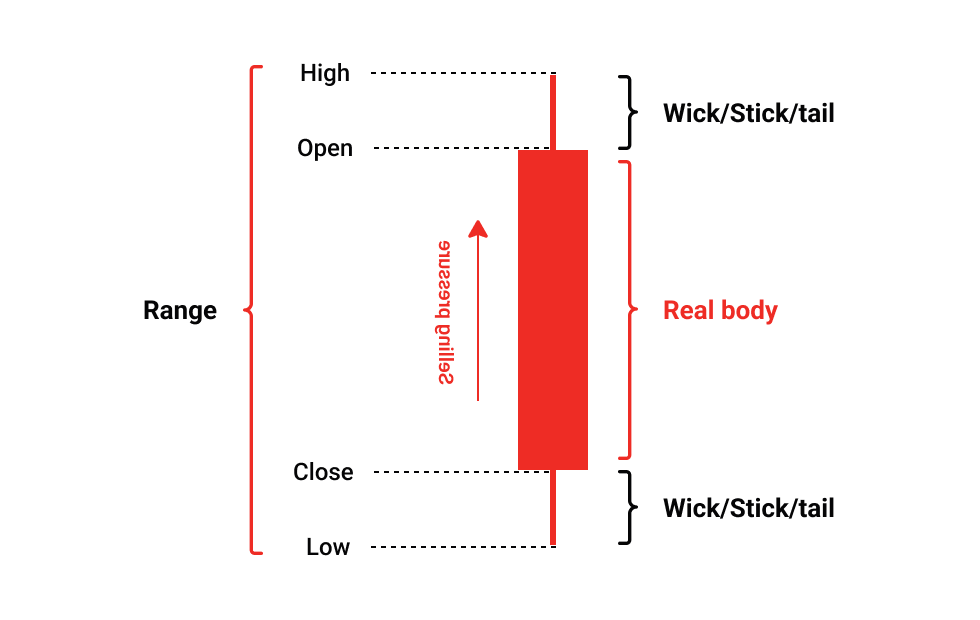

✤ Definition

☛ A candlestick that indicates price depreciation or downward movement during the selected time frame. It reflects that the closing price is lower than the opening price.

✤ Appearance

☛ The body of the candlestick is typically colored red or black (though colors can vary based on chart settings).

☛ Open price is at the top of the body.

☛ Close price is at the bottom of the body.

✤ Shadows (Wicks)

☛ Upper Shadow: Represents the highest price during the period.

☛ Lower Shadow: Represents the lowest price during the period.

✤ Interpretation

☛ Indicates that sellers (bears) are in control and are pushing prices downward.

☛ Common in downtrends or as part of bearish reversal patterns after an uptrend.