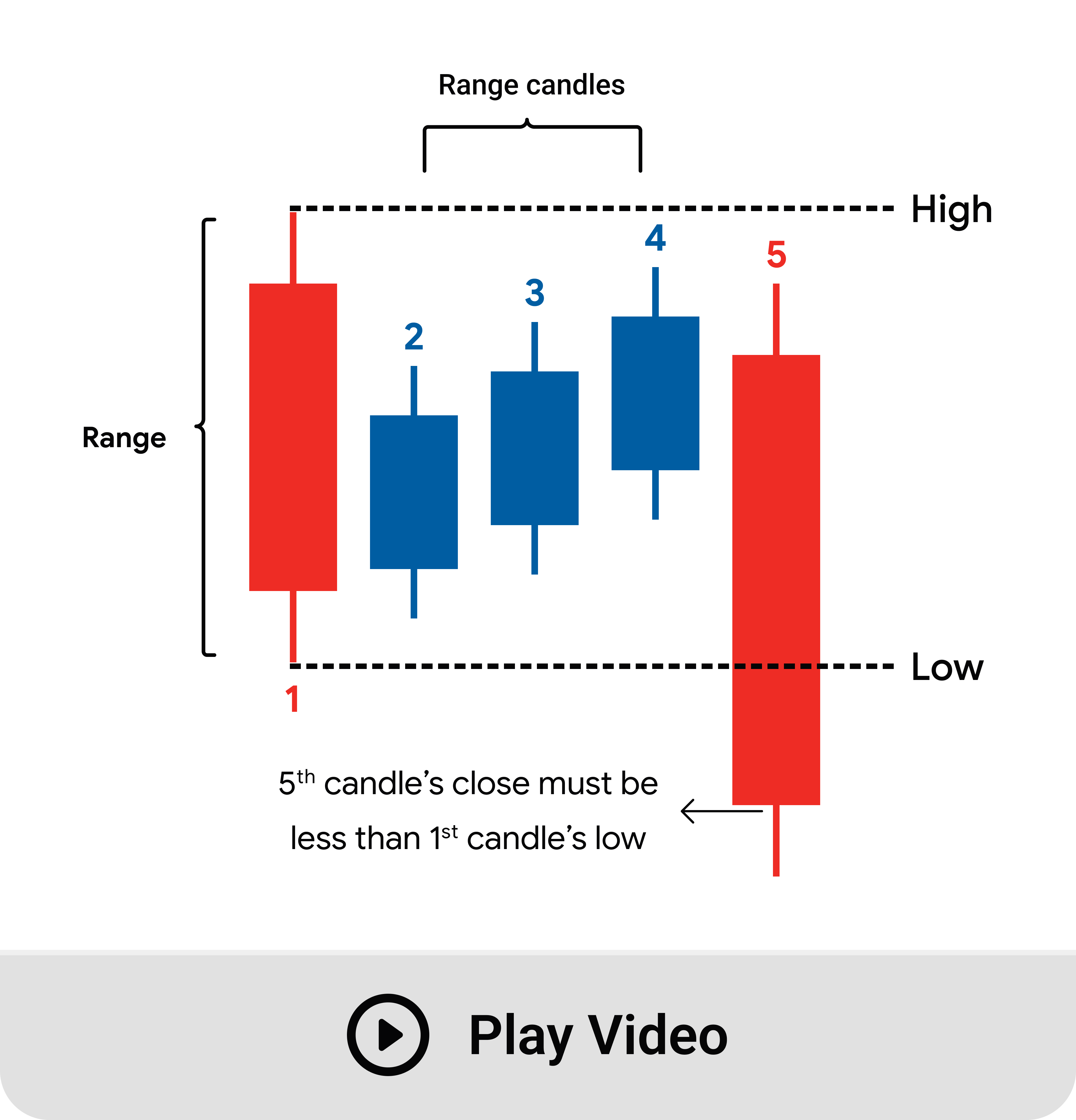

✤ Setup Conditions:

1. 1st candle’s close must be less than 1st candle’s open, it means 1st candle is a bearish candle.

2. 2nd to 4th range candle open, high, low and close must be less than entire range of 1st candle.

3. 2nd to 4th candle’s color doesn't matter, it may be bullish or bearish candles.

4. 5th candle’s close must be less than 5th candle’s open, it means 5th candle is a bearish candle.

5. 5th candle close must be less than 1st candle’s high, it means 5th candle is a breakdown candle.

The Falling Three Methods is a bearish continuation candlestick pattern that occurs during a downtrend. It signals a pause in the trend followed by a continuation of the downward movement.

✤ Key Characteristics:

✤ Trend Context

☛ Must appear in a downtrend.

✤ Structure

☛ First Candle: A long bearish (red) candle, indicating strong selling pressure.

☛ Next 3-4 Candles: Small bullish (green) candles that stay within the range of the first bearish candle (indicating weak buying or consolidation).

☛ Final Candle: A long bearish candle that closes below the first bearish candle's low, confirming the continuation of the downtrend.

✤ Meaning:

☛ The small bullish candle represent temporary consolidation or weak buying efforts during a downtrend

☛ The finalbearish candle shows sellers have regained control, resuming the downtrend.

✤ Confirmation:

☛ The final candle must close below the low of the first bearish candle to confirm the continuation of the trend.