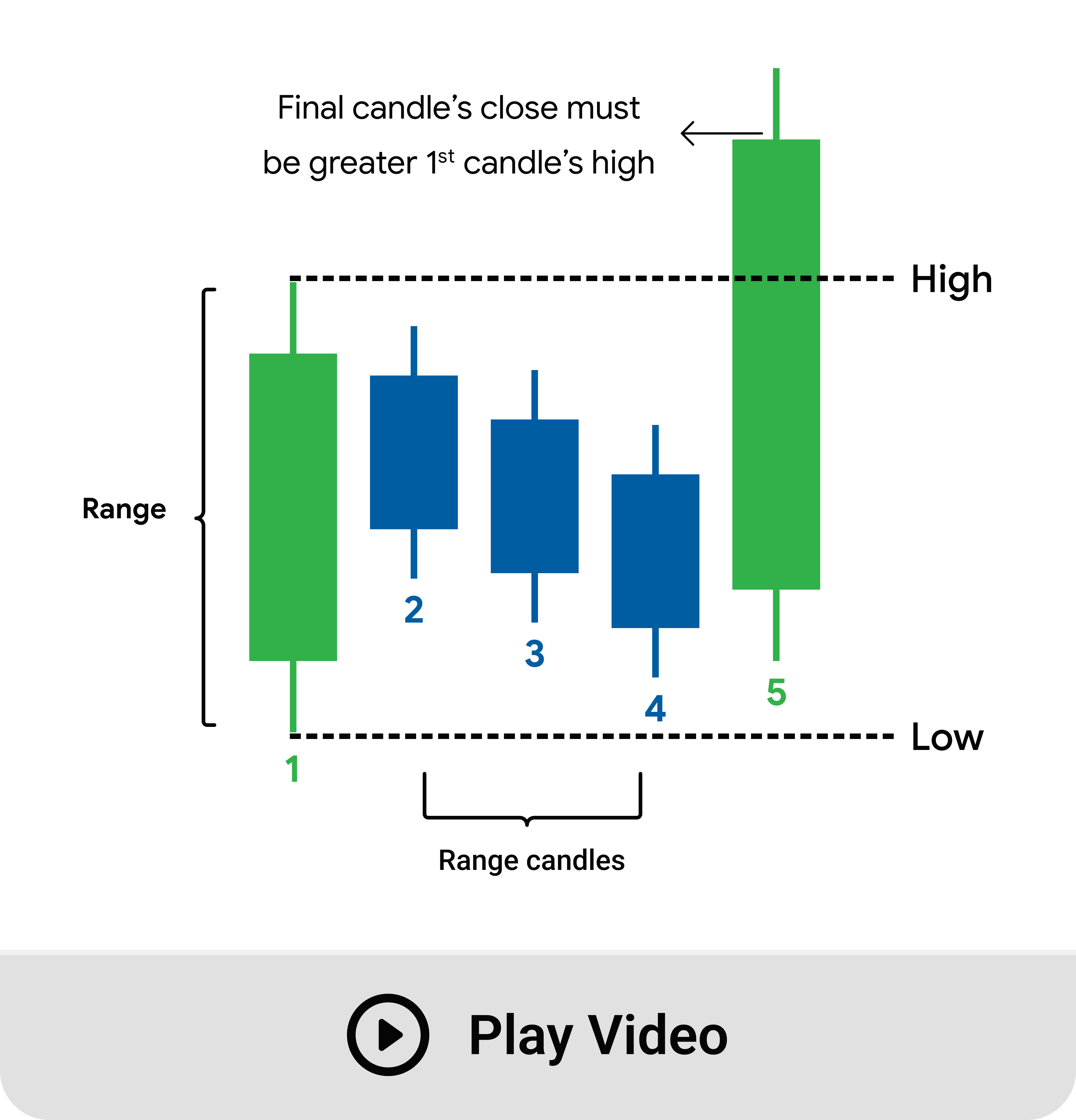

✤ Setup Conditions:

1. 1st candle’s close must be greater than 1st candle’s open, it means 1st candle is a bullish candle.

2. 2nd to 4th range candle open, high, low and close must be less than entire range of 1st candle.

3. 2nd to 4th candle’s color doesn't matter, it may be bullish or bearish candles.

4. 5th candle’s close must be greater than 5th candle’s open, it means 5th candle is a bullish candle.

5. 5th candle close must be greater than 1st candle’s high, it means 5th candle is a breakout candle.

The Rising Three Method is a bullish continuation candlestick pattern that occurs during an uptrend. It signifies a temporary pause in the trend, followed by a continuation of the upward movement.

✤ Key Characteristics:

✤ Trend Context

☛ Appears in a bullish uptrend

✤ Structure

☛ First Candle: A long bullish (green) candle, showing strong buying pressure.

☛ Next 3-4 Candles: Small bearish (red) candle that remain within the range of the first bullish candle (indicating weak selling or consolidation).

☛ Final Candle: A strong bullish candle that closes above the first candle’s high, confirming the continuation of the uptrend.

✤ Meaning:

☛ The small bearish candles reflect temporary profittaking or consolidation during the uptrend.

☛ The final strong bullish candle indicates that buyers have regained control, resuming the upward trend.

✤ Confirmation:

☛ The final bullish candle must close above the high of the first bullish candle to confirm the continuation of the trend.