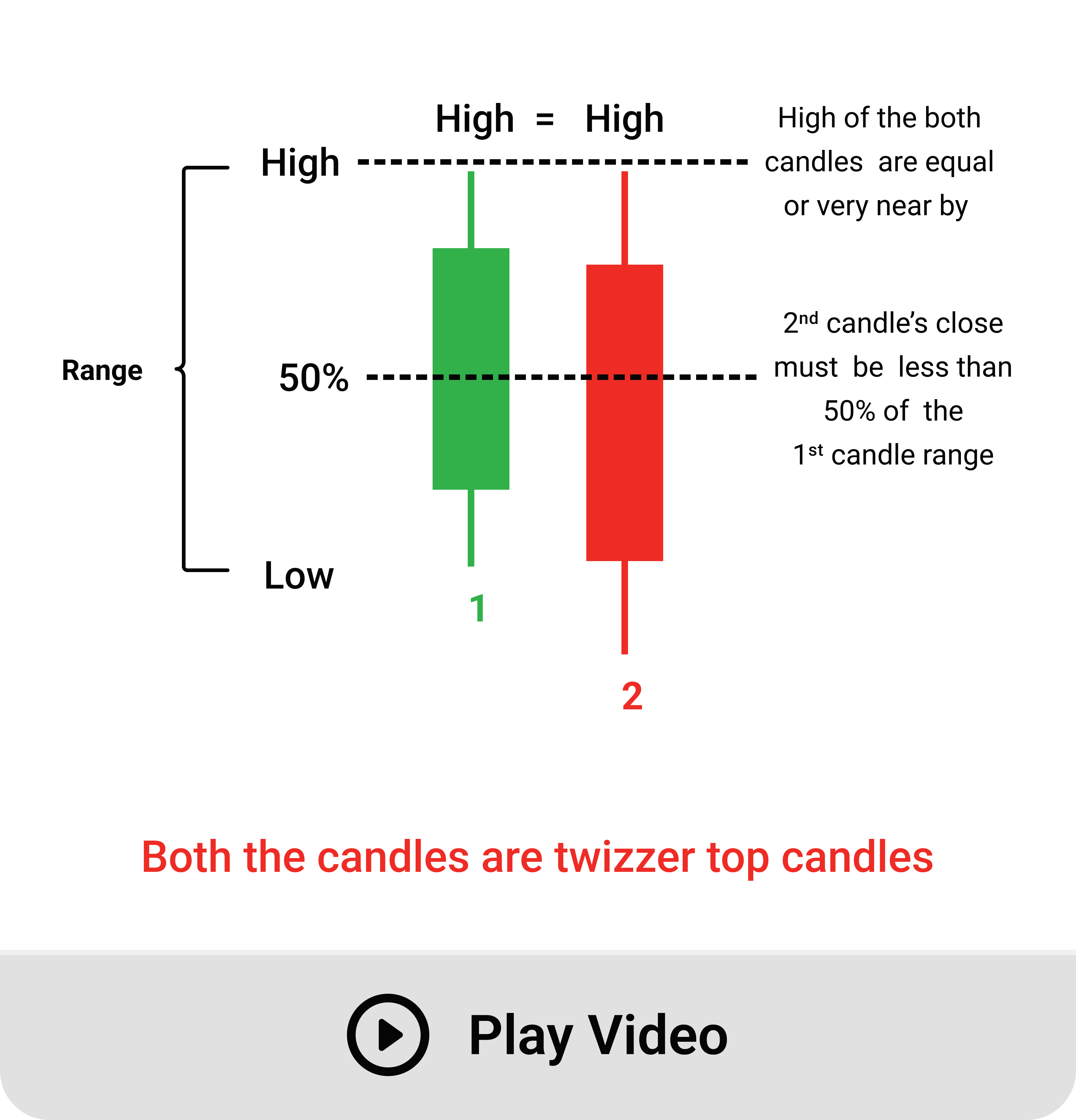

✤ Setup Conditions

1. 1st candle’s close must be greater than 1st candle’s open, it means 1st candle is a bullish candle.

2. 2nd candle’s close is less than 2nd candle’s open, it means 2nd candle is a bearish candle.

3. 2nd candle’s close must be less than 50% of the 1st candle’s entire range.

4. 2nd candle’s high must be equal to or very near by 1st candle's high.

5. 3rd candle confirmation needed.

A Tweezers Top is a bearish candlestick pattern that signals a potential reversal from a uptrend to an downtrend. It typically consists of two candles with matching or nearly matching highs, indicating a resistance level where the price struggles to move higher.

✤ Key Characteristics:

1. First Candle

☛ A bullish candlestick (green/white) that reflects strong buying momentum.

2. Second Candle

☛ A bearish candlestick (red/black) with a high equal to or slightly lower than the first candle's high.

☛ Both candles share a similar high, forming the "tweezer" shape.

✤ Interpretation

☛ Suggests that the market reached a resistance level, and sellers are starting to gain control.

☛ Work best when it appears at the top of an uptrend or near a key resistance level.

✤ Confirmation

☛ Traders look for the next candle to close lower, confirming the bearish reversal.